Chinese Aluminum Louver Facades in the U.S. Building Market: Current Status and Industry Impact

China is one of the world’s largest producers and exporters of aluminum products, supported by a highly integrated supply chain covering aluminum extrusion, surface finishing, and prefabricated architectural systems.

12/16/20254 min read

China is one of the world’s largest producers and exporters of aluminum products, supported by a highly integrated supply chain covering aluminum extrusion, surface finishing, and prefabricated architectural systems. Among these products, aluminum louver facades and shading systems have become increasingly visible in international architectural projects, including in the United States.

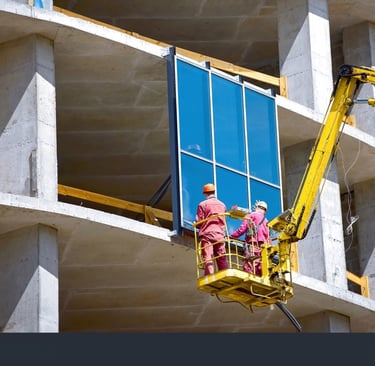

Used primarily for solar shading, façade articulation, ventilation control, and architectural expression, aluminum louvers are widely adopted in commercial buildings, mixed-use developments, and institutional projects. Despite growing trade barriers and regulatory scrutiny, Chinese-manufactured aluminum louver systems continue to influence the U.S. construction market in measurable ways.

This article examines the current status, market impact, and challenges of aluminum louver facades exported from China to the United States, based on publicly available trade data, government investigations, and building-performance research.

Although U.S. trade policy toward Chinese aluminum products has tightened significantly since 2018, China remains an important source of finished aluminum products and extrusions for the U.S. market. These products include architectural components used in curtain walls, shading systems, and façade assemblies.

According to international trade statistics and U.S. government reporting, aluminum extrusions and fabricated aluminum products continue to be imported into the United States despite additional tariffs, countervailing duties, and anti-dumping measures. While overall volumes have fluctuated, Chinese aluminum products still account for a meaningful share of U.S. aluminum imports in construction-related categories.

For aluminum louver facades specifically, many systems enter the U.S. market either as

Finished louver assemblies, or

Custom aluminum extrusions and fabricated components used by U.S. façade contractors for final assembly.

This creates a situation where dependency and restriction coexist: U.S. projects benefit from cost-competitive supply, while policy measures seek to protect domestic aluminum producers.

1. Trade Background: Ongoing Supply with Increasing Friction

The regulatory environment surrounding Chinese aluminum exports to the United States has become more complex and demanding.

Key policy factors include:

Anti-dumping and countervailing duties (AD/CVD) on aluminum extrusions

Section 232 tariffs applied to aluminum imports on national security grounds

Enhanced customs enforcement related to country of origin and supply-chain transparency

Forced labor compliance requirements, particularly under the Uyghur Forced Labor Prevention Act (UFLPA)

For U.S. importers and project owners, aluminum louver systems sourced from China now require more extensive documentation, including:

Clear origin declarations

Material traceability records

Factory compliance statements

Third-party testing and certification reports

As a result, aluminum louvers are no longer evaluated on price alone. Compliance cost, legal risk, and lead-time certainty have become equally important factors in procurement decisions.

2. U.S. Trade Policy and Compliance Pressure

Despite regulatory challenges, aluminum louver facades remain attractive in the U.S. building market due to their functional and performance benefits.

Well-designed louver systems can:

Reduce solar heat gain and cooling loads

Improve daylight control and visual comfort

Support passive design strategies aligned with energy codes

Enhance façade depth, rhythm, and architectural identity

Authoritative building-science research and government-backed design guidance consistently show that external shading devices can reduce annual cooling energy demand by approximately 5–15%, depending on climate zone, orientation, and glazing ratio.

3. Architectural and Performance Value of Aluminum Louvers

Because aluminum louvers are lightweight, corrosion-resistant, and highly customizable, they are especially suited to:

Warm and mixed climates (California, Texas, Southeast U.S.)

Commercial office buildings

Educational and institutional facilities

Transit-oriented and mixed-use developments

When performance requirements are met and properly documented, Chinese-manufactured systems can technically comply with U.S. energy and building standards.

The presence of Chinese aluminum louver products has produced both benefits and tensions within the U.S. market.

Positive impacts include:

Greater price competition and cost control for façade packages

Increased design flexibility through a wider range of extrusion profiles

Faster scaling for large or repetitive projects

Challenges and concerns include:

Competitive pressure on domestic aluminum extruders

Increased reliance on trade remedies to protect local manufacturing

Higher compliance and administrative burdens for importers

Risk exposure related to customs delays or shipment holds

In response, many U.S. contractors and developers are:

Prioritizing suppliers with strong compliance systems

Exploring local fabrication or partial assembly strategies

Requesting clearer warranties, testing reports, and liability coverage from overseas manufacturers

4. Impact on the U.S. Construction and Façade Industry

Looking forward, several trends are likely to shape the role of Chinese aluminum louver facades in the U.S. market:

Shift toward higher-performance products

Systems with verified thermal, durability, and sustainability credentials will have better acceptance.Increased emphasis on documentation and traceability

Compliance transparency will become a baseline requirement, not a competitive advantage.Hybrid supply models

Combining Chinese extrusion capacity with local finishing, assembly, or certification may reduce risk.Growth driven by energy codes and climate design

As U.S. energy standards continue to evolve, demand for external shading solutions is expected to remain strong.

5. Market Outlook and Future Direction

Chinese-exported aluminum louver facades continue to play a meaningful role in the U.S. construction market, offering cost efficiency, design flexibility, and scalable production capacity. At the same time, evolving trade policies and regulatory enforcement have significantly raised the bar for compliance and risk management.

For developers, architects, and façade contractors, success no longer depends solely on sourcing location, but on how well products meet performance standards, regulatory requirements, and long-term project risk expectations.

In this environment, aluminum louver systems from China can remain competitive — provided they are supported by robust documentation, transparent supply chains, and proven technical performance.

Conclusion

Innovation

quite

info@gbachasefacade.com

© 2024. All rights reserved.

window system

DOOR system